I’m sure you’ve heard many entrepreneurs say the same thing over and over and it always seems that being in “Start-up Stages” for 5+ years is the norm nowadays. But let’s be honest, the main priority is to get out of that start-up funk as soon as possible so you’re able to scale and grow quicker than your competitors. In this article, I’ll be going over the types of loans available to small businesses and how they work.

How Do Business Loans Work?

At SourcifyLending we work with 50+ lenders, and each lender specializes in a variety of loan options. For example, there’s a multitude of options that can be used for purchasing equipment, providing working capital, payroll, expansion. Some business loans include:

- Bank loans

- U.S. Small Business Administration (SBA) guaranteed loans

- Business Lines of Credit

- Equipment Loans

- Invoice financing or accounts receivable financing

- Merchant Cash Advances

Business loans are very unique as opposed to the traditional loans from banks, these loans come in many forms which are either in the form of installments or a revolving line of credit. When it comes to these types of loan products such as business lines of credit, it lets you borrow to a certain limit you can either pay off the balance each month or carry it over.

When it comes to Short-term business loans they’re mainly designed to provide working capital to buy inventory. Short term loans usually run for six to 24 months, as opposed to Long term loans that last about 3 years.

Then we have both secured business loans and unsecured business loans, which both are very useful depending on your industry and how fast you need the capital. The secured business loan requires you to put up collateral, this means if you fail to repay the loan the lender keeps your collateral.

An unsecured loan does not require any collateral at all, in fact, they are a lot easier to acquire than traditional loans, however, unsecured loans have a much higher interest rate than a secured business loan.

What Are The Steps To Getting A Business Loan

These some concepts we’ve picked up over time that can help you find the right financing source that can provide you with the loan you need.

- Do your research and decide how much money you need. When you submit your application to SourcifyLending and we ask “how much money does your business need to borrow?” the right answer isn’t “I’ll take whatever you can give me!”. The lenders we work with want to see that you’ve carefully thought this through and set goals on how you’re going to use the capital towards your business.

- Decide which loan fits best for your business. Once you’ve figured out how much money you need and what it’s purpose will be used for then you can start digging into the types of loans out there and how they work.

- Bank loans: These types of loans are installment loans that are paid back in fixed monthly payments, they are typically six to 24 months which is considered a short term loan. They can also be long term loans which range from 3 years and more.

- SBA loans: The SBA is a government agency that was created to help small businesses, but they don’t actually make the loans. They partnered with select lenders like banks, credit unions, and even non-profit organizations that guarantee a portion of the loan it makes to small businesses.

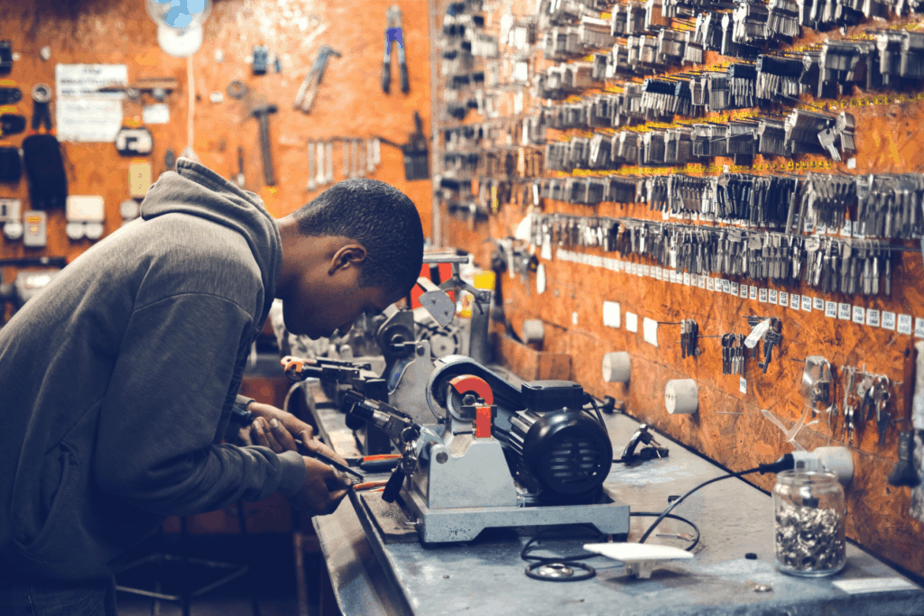

- Equipment Loans: At some point in your business you’ll need to purchase additional equipment to scale and grow, considering an equipment loan maybe your best option. These types of loans are similar to a car loan, the equipment itself that you’re purchasing is the collateral.

- Business Lines Of Credit: A business line of credit is a great option especially if your customers take a little longer than most (based on your industry), these lines of business credit can definitely help in ensuring that you don’t run out of working capital as you’re waiting for the payments to come in.

Check Your Personal Credit Scores

When it comes to credit, in general, there are two types of credit scores: there’s business credit and personal credit. Keep in mind that when you’re in start-up stages you won’t likely have a credit history because you haven’t been in business that long. Therefore lenders will be more focused on your personal credit to determine whether they can fund your business or not. But if you’ve been in business a while and the business is showing growth then your personal credit won’t matter as much.

Apply For A Business Loan

Depending on the lender (virtually most lenders) will take up to weeks or evens months to get your loan approved, but with SourcifyLending once you fill out our application we’ll have an offer for you the very next day and funds in your business bank account the very next day. Our priority is to mitigate any risks and take time out of the traditional loan process. For more details email us: support@sourcifylending.com